Investing for long-term growth is one of the most effective ways to build wealth and secure financial independence. While short-term gains may be tempting, focusing on long-term strategies allows your investments to grow steadily over time, leveraging the power of compound interest. In 2024, with market fluctuations and economic uncertainties, it’s crucial to develop a thoughtful investment strategy that maximizes growth while managing risks. This guide will walk you through the key long-term investment strategies for building wealth in 2024 and beyond.

1. Start Early to Maximize Compound Growth

The sooner you start investing, the more time your money has to grow. This is due to compound interest, where the returns you earn on your investments begin to generate their own returns over time. Even small contributions can grow significantly over decades.

Why compound growth matters:

- The power of time: For example, if you invest $10,000 at an annual return of 7%, after 10 years you’ll have roughly $19,670. After 20 years, you’ll have $38,697. The longer your investment horizon, the greater the benefit of compounding.

- Small amounts make a big difference: Starting early allows you to invest smaller amounts and still achieve substantial growth. Waiting too long requires larger investments to achieve the same result.

Key tip: Start investing as early as possible, even if the amount is small. The compounding effect becomes more powerful over time, so earlier investments will yield larger returns later.

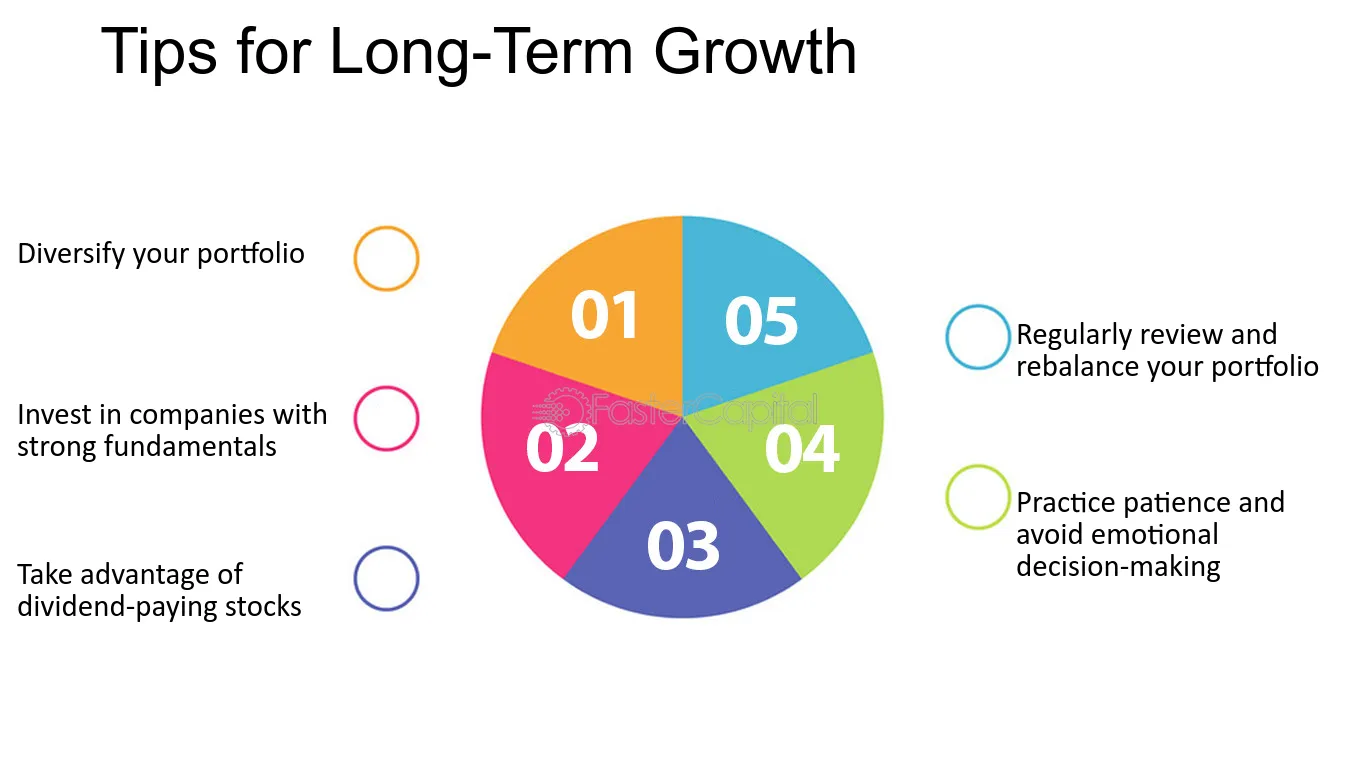

2. Diversify Your Portfolio

One of the fundamental principles of investing for long-term growth is diversification. Diversifying your investments across various asset classes, industries, and geographies can reduce your overall risk and improve returns. By spreading your investments, you protect your portfolio from significant losses in any one area.

Ways to diversify your investments:

- Asset classes: Invest in a mix of stocks, bonds, real estate, and commodities. Stocks provide higher growth potential, while bonds offer stability. Real estate and commodities can act as hedges against inflation.

- Geographical diversification: Include international investments in your portfolio to reduce risk associated with a single country or region’s economic performance. Global diversification also allows you to benefit from growth in emerging markets.

- Sector diversification: Spread your investments across different industries such as technology, healthcare, energy, and finance. This reduces the risk of being overly exposed to one sector.

Key tip: A diversified portfolio lowers the risk of volatility and provides more consistent returns over time. In 2024, focus on balancing growth assets with more stable, conservative investments to weather market fluctuations.

3. Invest in Index Funds and ETFs

For most long-term investors, index funds and exchange-traded funds (ETFs) are ideal vehicles for growth. These funds allow you to invest in a broad basket of stocks or bonds, offering diversification at a low cost. Index funds, in particular, are designed to track a specific market index, like the S&P 500, making them a low-maintenance and cost-effective option.

Benefits of index funds and ETFs:

- Low fees: Index funds and ETFs generally have lower fees compared to actively managed funds, which means more of your money goes toward growth rather than management costs.

- Market-matching returns: Over time, most actively managed funds fail to outperform the market. Index funds simply track the market, offering consistent returns in line with overall market performance.

- Simplicity: These funds are easy to manage and require little ongoing oversight, making them an excellent option for passive investors.

Key tip: In 2024, consider allocating a significant portion of your portfolio to index funds and ETFs. They offer a straightforward way to diversify your investments and participate in long-term market growth.

4. Rebalance Your Portfolio Regularly

Rebalancing is the process of realigning your investment portfolio to its original asset allocation strategy. Over time, some investments may outperform others, causing your portfolio to drift away from your desired risk level. Rebalancing helps you maintain your target asset allocation and ensures that you’re not overly exposed to risk.

How to rebalance your portfolio:

- Set a schedule: Rebalance your portfolio at regular intervals, such as annually or semi-annually. Alternatively, rebalance when one asset class exceeds its target allocation by a certain percentage (e.g., 5%).

- Sell high, buy low: Rebalancing involves selling some of your higher-performing assets and using the proceeds to buy more of the underperforming assets. This may seem counterintuitive, but it helps ensure you’re not overly exposed to market highs and that you can benefit from potential future growth in other areas.

- Stay disciplined: Market conditions can tempt you to deviate from your long-term strategy. However, sticking to your rebalancing plan will help you maintain a diversified and growth-oriented portfolio over time.

Key tip: Regular rebalancing helps maintain a healthy risk-reward balance in your portfolio, ensuring that you continue to invest in areas with growth potential without being overexposed to riskier assets.

5. Focus on Dividend Growth Stocks

Dividend growth stocks are shares in companies that regularly increase their dividend payments. These companies are typically well-established, financially stable, and generate consistent cash flow, making them a solid choice for long-term investors seeking growth.

Why invest in dividend growth stocks:

- Steady income: Dividend payments provide a regular income stream that can be reinvested to compound returns over time.

- Potential for capital appreciation: In addition to regular dividend payments, dividend growth stocks often experience price appreciation, providing both income and growth potential.

- Inflation hedge: Dividend payments tend to increase over time, helping to offset the impact of inflation on your investment returns.

Key tip: In 2024, look for companies with a strong history of increasing dividends, solid financial health, and competitive advantages in their industries. Reinvesting dividends can significantly boost your long-term returns.

6. Invest in Growth Stocks

Growth stocks are shares in companies that are expected to grow their earnings faster than the overall market. These companies typically reinvest profits into expansion rather than paying dividends, meaning investors rely on stock price appreciation for returns.

Why invest in growth stocks:

- High potential returns: Growth stocks offer the potential for significant capital appreciation, as companies that successfully expand can see their stock prices soar.

- Innovative industries: Growth companies are often leaders in cutting-edge industries like technology, healthcare, and renewable energy, providing opportunities to invest in emerging trends.

Key tip: While growth stocks offer high returns, they also come with higher risk. In 2024, consider allocating a portion of your portfolio to growth stocks but balance it with more stable investments like dividend stocks or bonds to manage risk.

7. Consider Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy where you consistently invest a fixed amount of money at regular intervals, regardless of market conditions. This approach reduces the impact of market volatility and prevents you from making poor timing decisions.

Benefits of dollar-cost averaging:

- Reduces market timing risk: DCA eliminates the need to predict market highs and lows. By investing regularly, you buy more shares when prices are low and fewer shares when prices are high, which can lower your average cost per share over time.

- Builds discipline: Regular investing encourages disciplined financial habits and helps you avoid emotional decisions that can lead to poor investment choices.

Key tip: In 2024, consider using dollar-cost averaging for your investments, especially in volatile markets. This approach allows you to invest steadily over time, taking advantage of both market dips and rallies.

8. Take Advantage of Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged accounts like 401(k)s, IRAs, and Roth IRAs is an essential part of any long-term investment strategy. These accounts offer tax benefits that can significantly enhance your investment returns over time.

Types of tax-advantaged accounts:

- Traditional 401(k) and IRA: Contributions are made with pre-tax dollars, reducing your taxable income in the year you contribute. Earnings grow tax-deferred, and you pay taxes only when you withdraw the funds in retirement.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free, making it an excellent option for long-term growth, especially if you expect to be in a higher tax bracket in retirement.

Key tip: In 2024, aim to maximize your contributions to tax-advantaged accounts to reduce your tax burden and allow your investments to grow tax-free or tax-deferred, enhancing your overall returns.

9. Stay the Course and Avoid Emotional Investing

Long-term investing requires patience and discipline. Market volatility, economic uncertainty, and media noise can tempt investors to make impulsive decisions, like selling during downturns or chasing high-risk opportunities. However, sticking to your long-term investment plan is critical to achieving sustained growth.

How to avoid emotional investing:

- Have a plan: Develop a clear investment strategy with defined goals and risk tolerance. Write down your plan and refer to it during volatile periods to stay focused.

- Ignore market noise: Short-term market fluctuations are normal. Resist the urge to panic during market downturns or get swept up in speculative hype.

- Focus on the long term: Keep your long-term goals in mind. Remember that investing is a marathon, not a sprint, and staying invested through market ups and downs is key to long-term success.

Key tip: In 2024, maintain a long-term perspective. Stick to your investment strategy, rebalance as needed,